Introduction

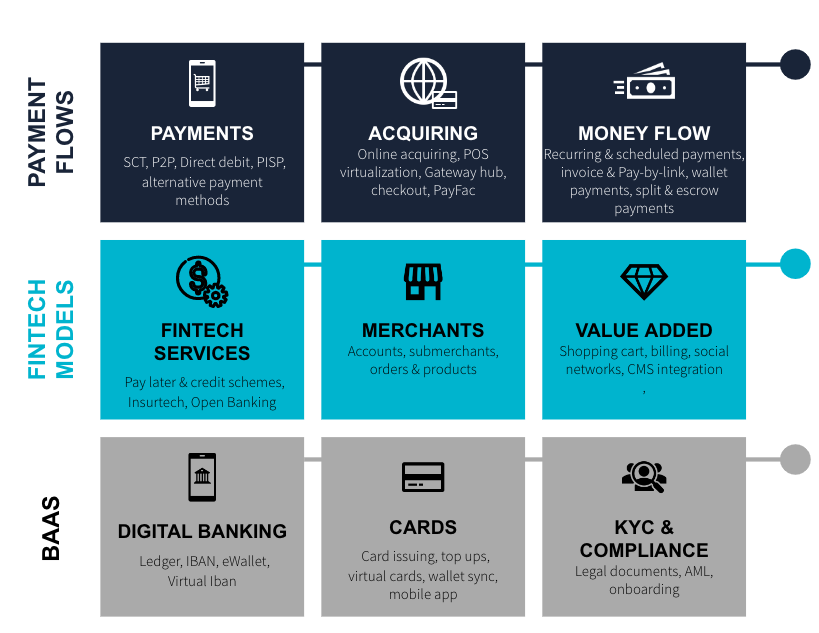

Truust.io is a powerful and innovative technological payment platform that allows customized money flows for digital business models.

Truust.io is the first Payments-as-a-Service platform. Clients can easily prototype, build and scale every use case connecting our available financial services or demanding new ones.

One-stop shop payment solution

Companies and brands that know their customers and are creating innovative and more personal customer journeys.

- We manage the entire payment flow, enabling companies and digital business models to integrate existing banking services into their value chain.

- A simple API for developers to build and embed existing financial services directly into apps, business models and customer journeys.

- Truust offers a one-stop shop service acting as the sole interlocutor for providing all financial services.

Streamlined API integrations: an API-first, developer-friendly approach that reduces friction for both customers and banks, enabling access to multiple services with a single integration

Multi-tenant and white labeled: scalable and secure, our clients can safely deploy their branded applications

Managed & innovated: solutions can be hosted, always taking advantage of the pipeline of new services being integrated

With a unique vision

...where business and payments come together.

Digital business models start and finish with money flows, we put payments on top to help our customers focus on transaction flows and business rules.

- Business rules & models: A powerful payment flow engine on top with out-of-the-box workflows and business rules enables companies to quickly implement new digital business models.

- E-commerce, Platforms/marketplace, Payment Facilitator: all fintech models have been built where banks partners and financial service companies are seamless integrated.

- Multiple banking relationships: giving customers more leverage in pricing, allowing for a more diverse array of banking products, and reducing the overall security, regulatory, and compliance risk of being dependent on a single bank.

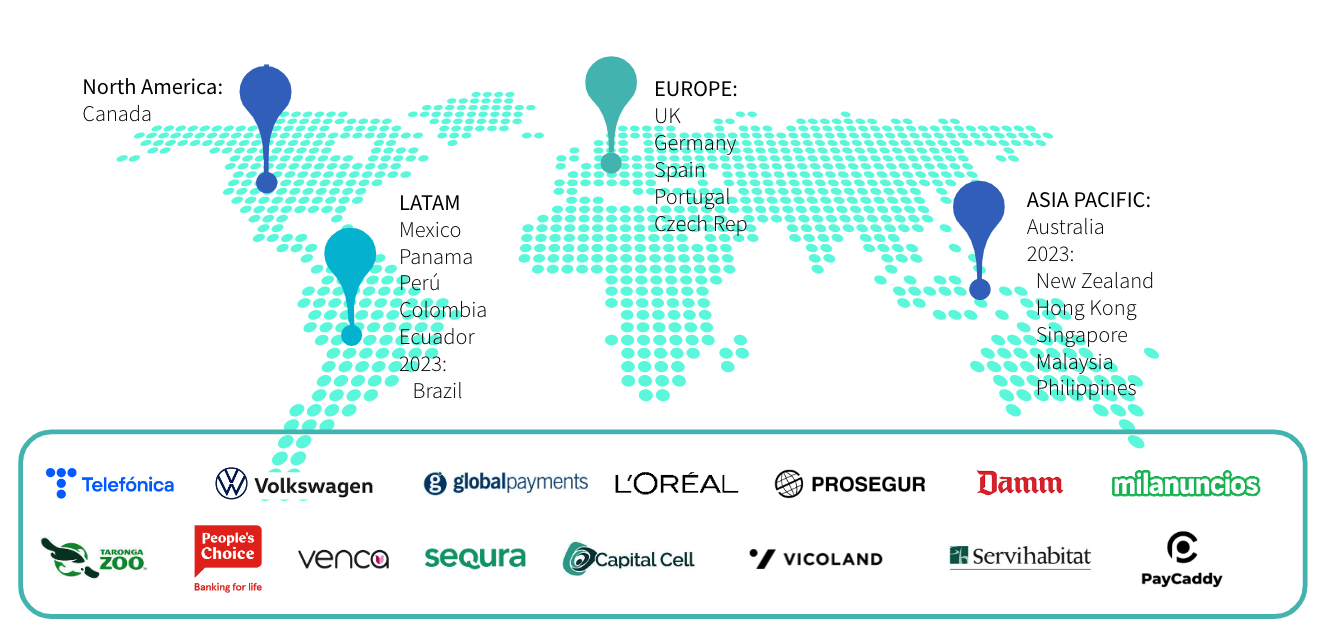

And global footprint

Our customers are companies that require modern payment solutions. We serve more than 60 clients around the globe, representing 5K+ merchants.